SMB financial services have gone digital. To attract and retain the next generation of SMB customers requires differentiated digital experiences, tools to build trust with borrowers, and incentive structures to encourage positive accountability.

* Embedded credit tools currently offered include certain business credit data from Equifax and Dun & Bradstreet

Yesterday, fully-online account opening, credit applications, and money movement were differentiators.

Today, they're table stakes.

SMB owners are looking for refined digital experiences and financial partners invested in their long-term business success (not just funding). That means higher engagement, more opportunities for cross-selling, higher credit usage and deposits, and lower delinquencies.

.svg)

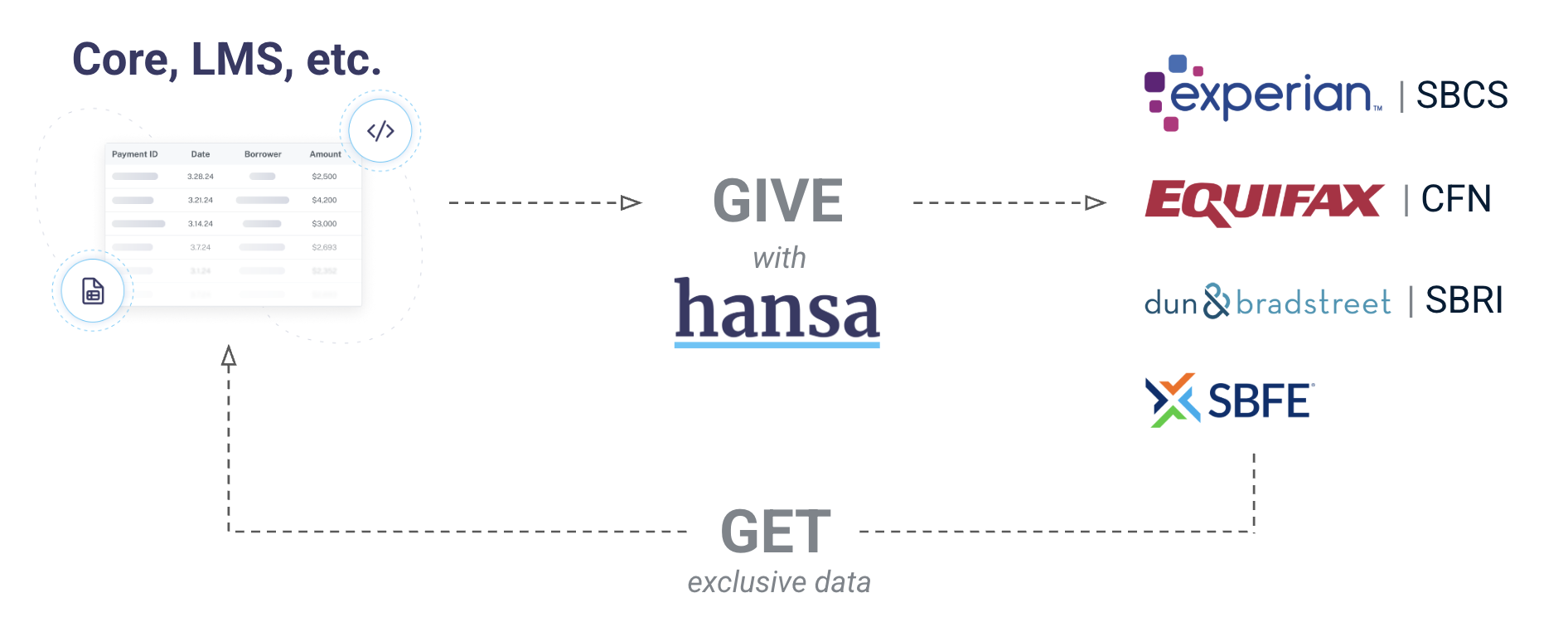

Between credentialing, compliance, and dispute management, Hansa automates the hardest parts of credit reporting. This allows you to access better underwriting data, but without worrying about the overhead of starting and maintaining a credit reporting practice.

With a simple CSV export or API connection, Hansa can ingest your loan or spend tape in its raw form, transform it, and transmit it to all major commercial bureaus and consortia.

Borrowers who know their credit is reported are more likely to pay on time.2

Email and text notifications drive down delinquency risk and give borrowers a chance to catch up.

Let's level up your business credit practice with borrower tools that reward accountability.

The Wall Street Journal - “Of the firms that did check their reports, one quarter said they found errors [...] that put their business in a riskier category”

Antonio Doblas-Madrid, Raoul Minetti (2013) studies the effects of joining a credit bureau. In the conclusion, they separate the extensive effects of joining a bureau (access to information to vet borrowers) from the intensive effects (improved repayment performance). The calculation on the latter saw a decrease in the probability of serious delinquency (90+ days) from a 7.3% > 5.7% chance. Actual results reporting through Hansa may vary.

We conducted a survey of 200 small business owners across the US. 172 of them responded that it was "important" or "very important" to have their loan payments reported to the credit bureaus.